Commercial Auto

What Commercial Auto Insurance Is All About:

From accidents to injuries, having a commercial vehicle for your business comes with many risks. However, for many businesses having a company vehicle is crucial, which means having the right protections in place are just as crucial as having the vehicle itself.

Let us introduce you to Commercial Auto Insurance. The insurance that protects your business from vehicle-related accidents, so you can sit back and enjoy the ride.

Read on to understand if this insurance is right for your company.

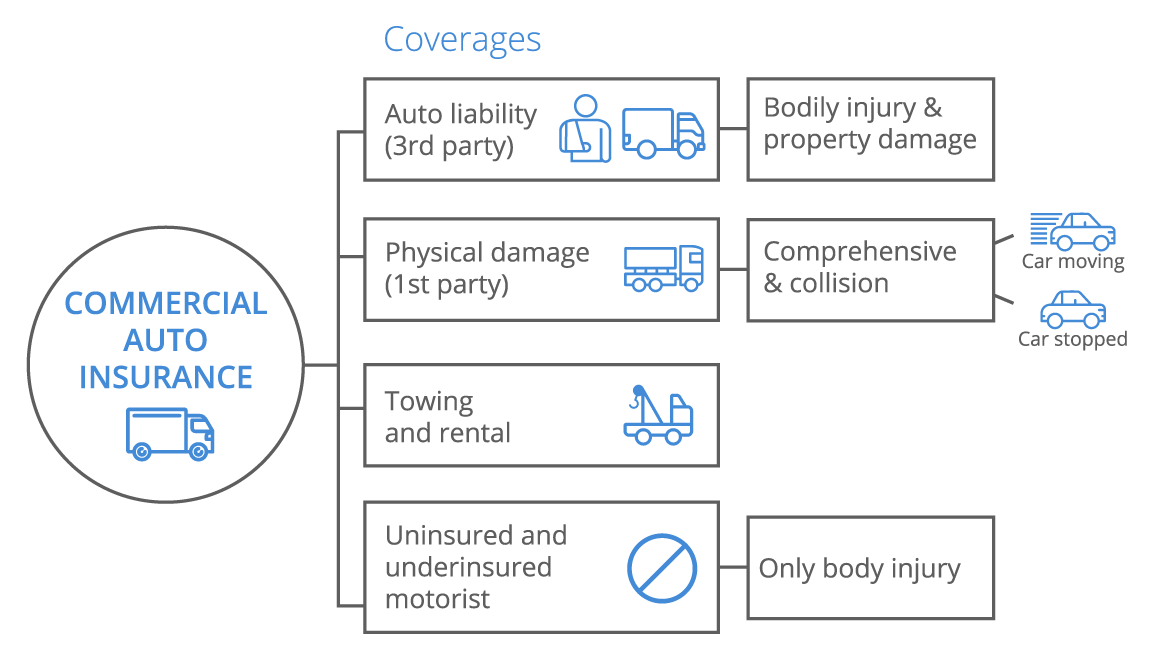

What Is Commercial Auto Insurance Coverage?

Business Automobile Liability Insurance is for businesses that own and operate vehicles. This insurance helps companies cover the costs of repairing or replacing company vehicles within the boundaries of the insurance policy.

Every business that uses vehicles to transact business needs Commercial Auto Insurance. Companies using their personal vehicles for business-related purposes may find that their personal insurance does not cover business-related risks. Personal Auto Insurance on a vehicle used for business purposes may not have enough insurance, leaving the company financially responsible for losses.

Business Automobile Liability Insurance was purposefully designed to help protect businesses from the unknown. With higher coverage limits than personal auto insurance, it helps safeguard businesses and improves a business’ chances of continual operations.

Commercial insurance contracts create partnerships between companies and insurers. Under these contracts, insurers are required to pay for physical damages based on the terms of the insurance policy and up to the limits of the insurance coverage. Insurers can’t cancel Commercial Auto Insurance if a business files a claim against the insurance policy.

Businesses can purchase Commercial Auto Liability coverage for their cars, trucks, heavy-duty trucks, and semi-trucks.

Depending on the coverage selected, this insurance covers vehicles the business owns, contracts with, and leases. It also helps cover injured employees should an accident happen.