Workers Compensation

What is Workers Compensation Insurance and Why is it Used?

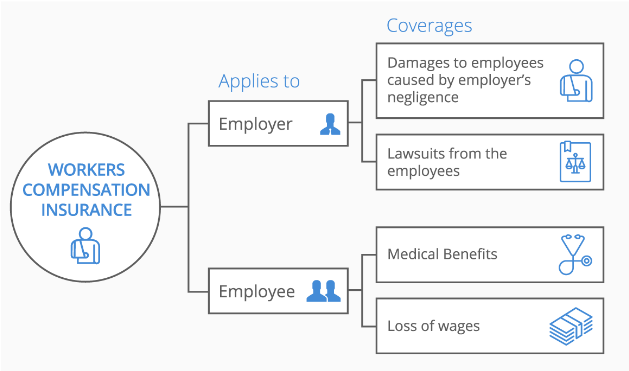

Workers Compensation insurance covers an employer’s obligations under workers compensation laws, which make employers responsible for stated damages in the event of a work related injury or illness.

Employee compensation consists of medical expenses, disability benefits, and death benefits. Employers Liability covers the insured for claims by employees for injuries not subject to workers compensation law; claims by others for the liabilities to insured’s employees; and claims by relatives of injured employees for consequential damages.

Often called “Workman’s Comp,” this insurance covers the occurence of employee injuries. It provides wage replacement and medical benefits to employees who are injured at work.

In exchange, employees relinquish their right to sue their employer for negligence. Therefore, Workers Compensation Insurance protects employers from costly lawsuits while also assuring employees that they are guaranteed some coverage in case of illness or injury on the job.

How Does Workers Compensation Insurance Work?

When a business owner has Workers Comp Insurance, their employees who become injured or disabled at work will not need to pay their medical bills, as these will be covered under the policy.

The injured employee will also receive monetary compensation to cover lost wages, either during the recovery stage, or longer, depending on the extent of the physical harm or disability suffered.

Employers Liability covers the insured for claims by employees for injuries not subject to workers compensation law; claims by others for the liabilities to insured’s employees; and claims by relatives of injured employees for consequential damages.

Employee compensation consists of medical expenses, disability benefits, and death benefits.

What is Workers Compensation Insurance all about?

It’s your job to keep employees safe at work. However, work-related injuries happen. Sometimes employees get injured on the job, and that’s why we have Workers Compensation Insurance.

This insurance covers medical costs and lost wages, as well as rehabilitation or physical therapy. It’s mandatory in many states and highly recommended for all employers. Read on to discover what your business should look for in a workmans comp insurance policy.

What Is Covered Under Workmen Compensation Insurance?

Accident or Injury

If an employee gets into a road accident while using their vehicle for work purposes, workers compensation insurance will cover the injured employee’s medical expenses and a portion of their lost wages. However, accidents that occur while an employee is commuting to or from work are not covered.

Occupational Illness

Workplace injuries include occupational hazards, such as falls from heights or inhalation of harmful chemicals. Workman’s Compensation Insurance can cover medical expenses and a portion of lost wages, as long as there is a clear connection between the job and the illness suffered.

Repetitive Stress Injury

Claims are common for injuries due to repetitive physical motions. Insurance will cover any rehabilitation or therapy that an employee may need. An example of repetitive stress injury is carpal tunnel syndrome that affects millions of office workers.

Disability

If an employee suffers an ongoing disability at or due to work, workmens comp insurance will cover their medical bills, as well as a portion of their wages. For example, if an employee is injured in a car accident while on the job that results in a leg amputation, Workers Comp Insurance aims to compensate lost wages due to their inability to ¡go back to work.

Act Now, Get Protected Easily, Quickly and Affordably

See how much you could be saving, with best in class insurance partners. Start your application and get a free quote in minutes.

Or call (646) 844-9933 anytime.